After hitting an all time high at $699.54, Adobe (ADBE) stock, much like other technology companies and Nasdaq, has been sliding and was cut almost in half to $338 by mid Jun 2022.

So, from short term trading perspective, is there an opportunity? And if yes, how should one trade this?

In this article, I look into ADBE from a possible bullish trade perspective and suggest a trade set-up that might provide good returns.

What Does Adobe (ADBE) do?

Adobe Inc. (ADBE) operates as a diversified software company worldwide. It operates through three segments: Digital Media, Digital Experience, and Publishing and Advertising.

The Digital Media's flagship product is Creative Cloud, a subscription service that allows members to access its creative products. This segment serves content creators, workers, marketers, educators, enthusiasts, communicators, and consumers.

The Digital Experience segment provides an integrated platform and set of applications and services that enable brands and businesses to create, manage, execute, measure, monetize, and optimize customer experiences from analytics to commerce.

The Publishing and Advertising segment offers products and services, such as e-learning solutions, technical document publishing, web conferencing, document and forms platform, web application development, and high-end printing, as well as Advertising Cloud offerings.

Adobe Inc. was founded in 1982 and is headquartered in San Jose, California.

So, What's the opportunity?

Adobe is a fundamentally sound company and based on my valuation model it is currently selling below it's intrinsic value and makes for a good long term buy at current prices. However, that discussion for an another post. For short term trading, I am going to take cues from the charts.

Below is a 5 years, weekly chart of Adobe. I have drawn some trendlines and moving averages to the price chart.

Look closely and you will find that horizonal line provides a clue that prices are currently at pre-covid high levels (which is actually about 50% lower than all time high). So for any sutainable bullish set-up, it needs to close above that level first (around $400)!!

The diagonal line, 200wk sma and pre-covid high price, all seems to cross around the same price level.

I am also using one of my proprietary indicators to determine the volatility and trend (dotted pink line), and If you look closely, every time the price touches near the line there is a bounce!

While, those indicators suggest a bullish bias, it is no secret that currently tech stocks are in bear market. So what I am doing is really going contrarian and looking for a short term bullish trade and as I do that I need to minimize the risk of capital loss in case the trade goes against my analysis.

Here is my trade plan:

- Entry: Aggressive, now $380; conservative, above $400

- Target: $450+/-, then $480+/- and then $520

- Stop Loss: $340

- Holding time frame: 6 months

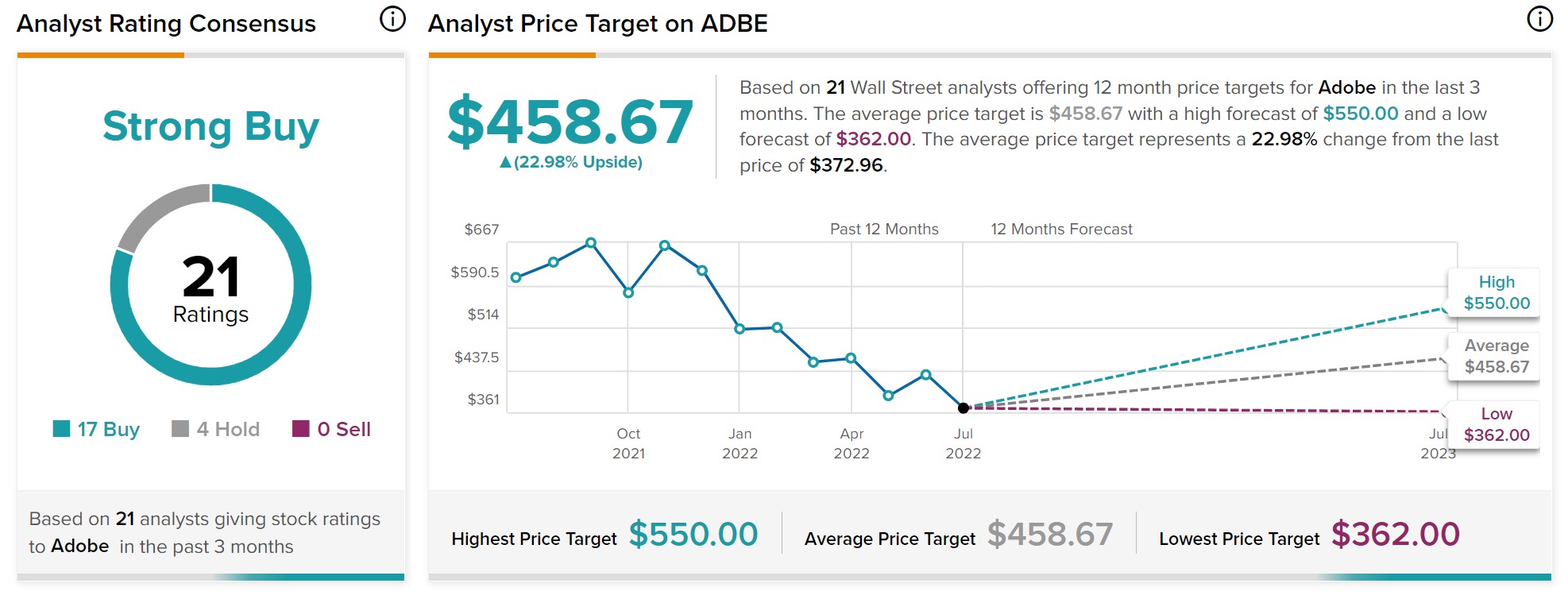

There are multiple ways to open a bullish trade. But before we jump into a trade set-up, lets review how wall street analysts are projecting their 12 months price targets (Yeah, average is around $460):

Whatever method you choose from below, you need to have a risk management plan in place and set your exit targets (In case of either profit or loss).

So here are 3 ways to invest for a bullish set-up:

Buying a stock

For those who like to buy and hold for the long term, purchasing ADBE shares might be a good idea. Assuming an investor wants to buy 100 shares of ADBE stock, they would have to invest around $37,300 at the current price of ~$373.

Profit & Loss calculation is simple. If the stock goes up by $1, you make $1 and if it goes down by $1, you lose $1.

If you do plan to hold it for long run, please do your diligence, crunch your numbers to figure out how much should you pay and if at $373 it offers you a good margin of safety.

Buying a Call option

Investors who think ADBE stock will continue to rally but don't want to risk significant capital they can instead use long call options. It's much cheaper than buying the stock outright.

A call option is a contract between a buyer and seller. The contract gives the buyer the right to purchase a certain stock at a certain price (strike price) up until a certain date (expiration date).

One of the benefits of call options is that a call option provides leverage as 1 option control 100 shares. Actually, said another way, an investor gains exposure to 100 shares using a fraction of the capital by buying a call option.

If an investor buys one ADBE 380 call option expiring on Jan 2023, they would only need to invest around $4,200 rather than $37,300 in buying 100 shares.

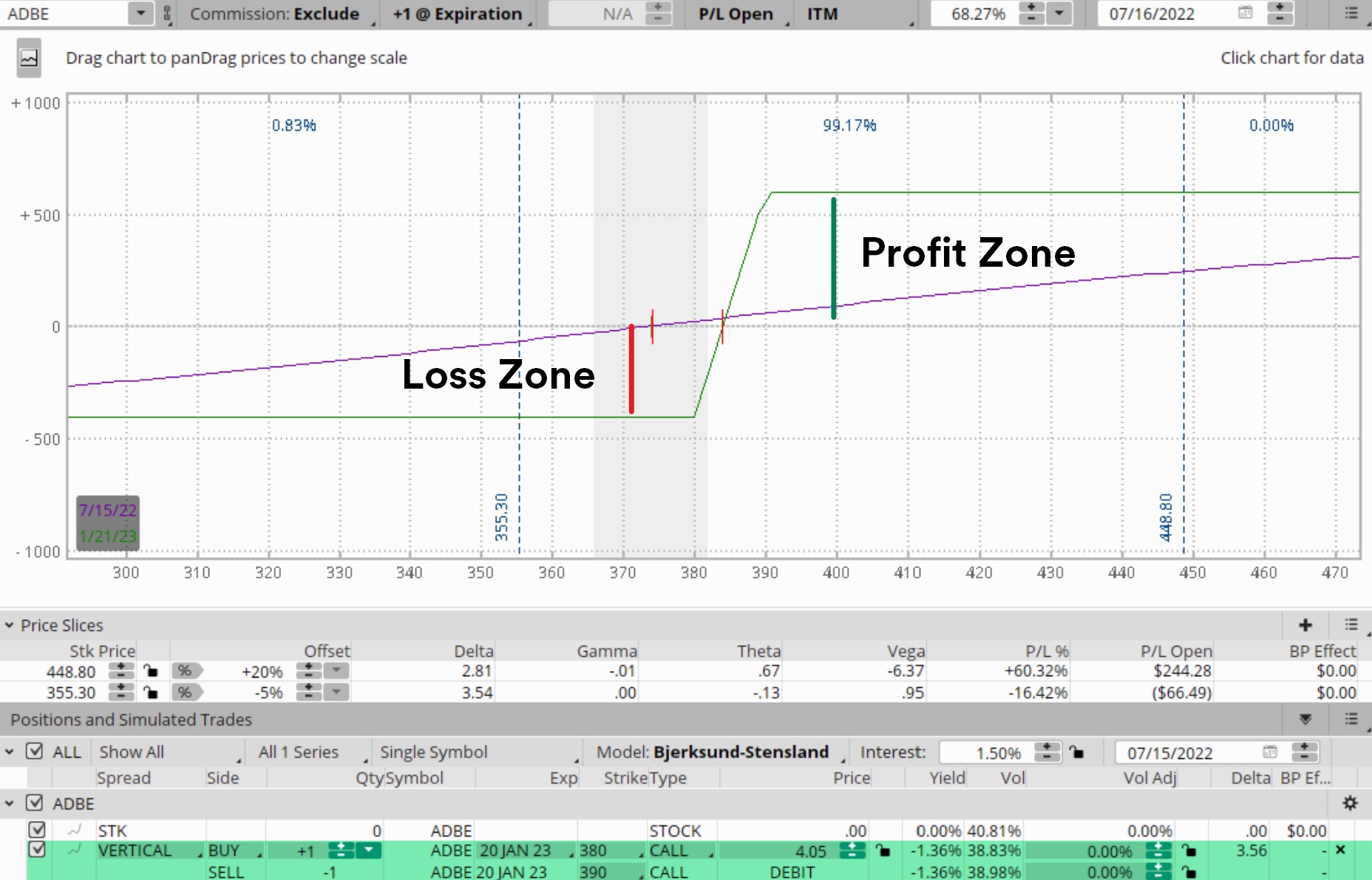

If today (shown as per purple curved line), say ADBE goes up by +20%, the gains on options will be +120% (or US$4995). If however, the stock tanks to our stop loss area, the loss would be -23% (or US$957). As good as it may seem, the call option will lose all of its time value (i.e. full $4200) should the stock remain below $380 by Jan 2023 and assuming you do nothing.

And there you go, that's one way to trade bullish bias via call options.

Introducing Call Debit Spread

Now what if someone doesn't want to spend $4200? Is there are other ways to be bullish but with less investment?

Well, this can be achieved via using options such as a debit call spread where investors can buy Jan 2023, strike 380 call options and sell strike 390 call options for the same expiry. Such a trade will cost only $410 and the maximum gains will be $590 or +143% if ADBE were to expire above $390 by Jan 2023!!

And this is the trade I am most comfortable with. So here is the exact trade:

- Buy Jan 2023, strike 380 call AND

- Sell Jan 2023, strike 390 call options

- Total debit: $410

- Max loss: $410

- Max Gains: $590

- Max holding period: 189 days.

So, how to visualize the entire trade set-up?

The break-even price for this spread on expiration is equal to the long call strike price plus the premium paid. For this trade, that makes a break-even price of $384.10 (i.e. $11 above current price). The most the trade can lose is the premium paid of $410. And this occurs if ADBE stock finishes below $380 on Jan 2023.

Bottom-line: These are just 3 of the many ways of trading a bullish bias on Adobe. Options trading is very much dependent upon how much you know and if you can think & act like an options trader and use different strategies as and when required.

If you have any questions, feel free to comment below.

Disclaimer: Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

Get Free Access to The Market Insider's Newsletter:

Want behind-the-scenes stock & options strategies and actionable insights delivered biweekly to your inbox? Join 40,000+ savvy investors and start growing your wealth!

*We send you weekly goodies to help you make more money. Unsubscribe anytime.