Investing and Flying are similar, in some ways.

Many new traders doubt if Paper Trading is still relevant? Does it do any good at all? They claim that it is a different “feel” when your actual hard earned money is at risk.

“Your emotions are your biggest baggage when it comes to trading and investing and so you need to go through the “real-pain or gain” to know “how it feels like” to be a trader”…many think that way…

There’s no denying on “feeling part”; albeit, emotions is just one aspect and in my opinion, it is not very important while you are beginning to learn trading. Its importance, however, grows over time.

So why should you pay attention to paper trading? Why is it still relevant and will continue to be relevant?

I trade on paper money even now…why?

Let’s categorises the reasons into four broad categories:

#1 To Know The Trading Platform

When you want to drive a car, you need to understand your car’s operations. You need to know how to start, stop, drive, turn, reverse, park etc., and the list goes on and on. Similarly, in order to execute your trades, you need a trading platform which is usually provided for free by your broker who opens your account and allows you to trade.

And guess what, you might have wonderful ideas, trading systems and strategies, but you can only execute those if you understand the trading platform.

So what are some of things you need to learn before you could place your first REAL-MONEY trade?

- You need to understand your account information which includes deposits, withdrawals, current balances and so on.

- You need to learn how to analyze, open, monitor and close positions for your desired trading strategy and system.

- Trade identification is one of the first areas you will have to spend time on so knowing how to find, filter and identify trades on your trading platform will be extremely useful.

- And if you are like most traders, you would want to watch market action and create watchlists, stock filters , etc. for keeping an eye on potential future opportunities.

This is just the beginning.

As you can see, you don’t wanna experiment all this with real-money.

By Paper trading or simulating real-trading environment on a virtual trading account, a newbie trader can avoid painful mistakes that are often triggered due to trading platform ignorance.

#2 To Understand Options Better

Options are different. Different from stocks, forex and other financial instruments that you might’ve been familiar with.

In order to avoid single biggest mistake that new traders commit when they start trading options, I suggest that you may want to read TOP 10 things about options. This will provide you with a primer on what is an option, call option, put option, option buying, option selling and some other characteristics of options such as expiration date etc.

Trading options usually involves more steps then simply buying and selling shares. The option price also changes differently to different market conditions. Paper trading first will help you understand how options are different from other instruments.

#3 To Manage Yourself Better

Just like any other other business, Trading business also involves a process. And process is best summarized via your, let's call it, standard operating procedure (SOP) that lists who you will find, filter, enter, manage and exit a trade.

Before you commit to real money capital, you need to show, prove to yourself that you can actually follow your own trading systems and strategies. Notice, I didn’t say Profit & Loss; for a new trader learning and mastering the whole process is more important.

Do you do proper preparations? Do you have patience, persistence and perseverance to follow through your complete trade’s process?

Paper trading thus becomes an invaluable tool so you could check your discipline and adherence to your trading plans. The more you practice your trading process on paper money, the more painful mistakes you will avoid in future.

That leads me to emotional aspect of the trading process.

There are two very powerful human emotions that can affect the outcome of your trading results massively. Fear and Greed.

Let’s go through an example:

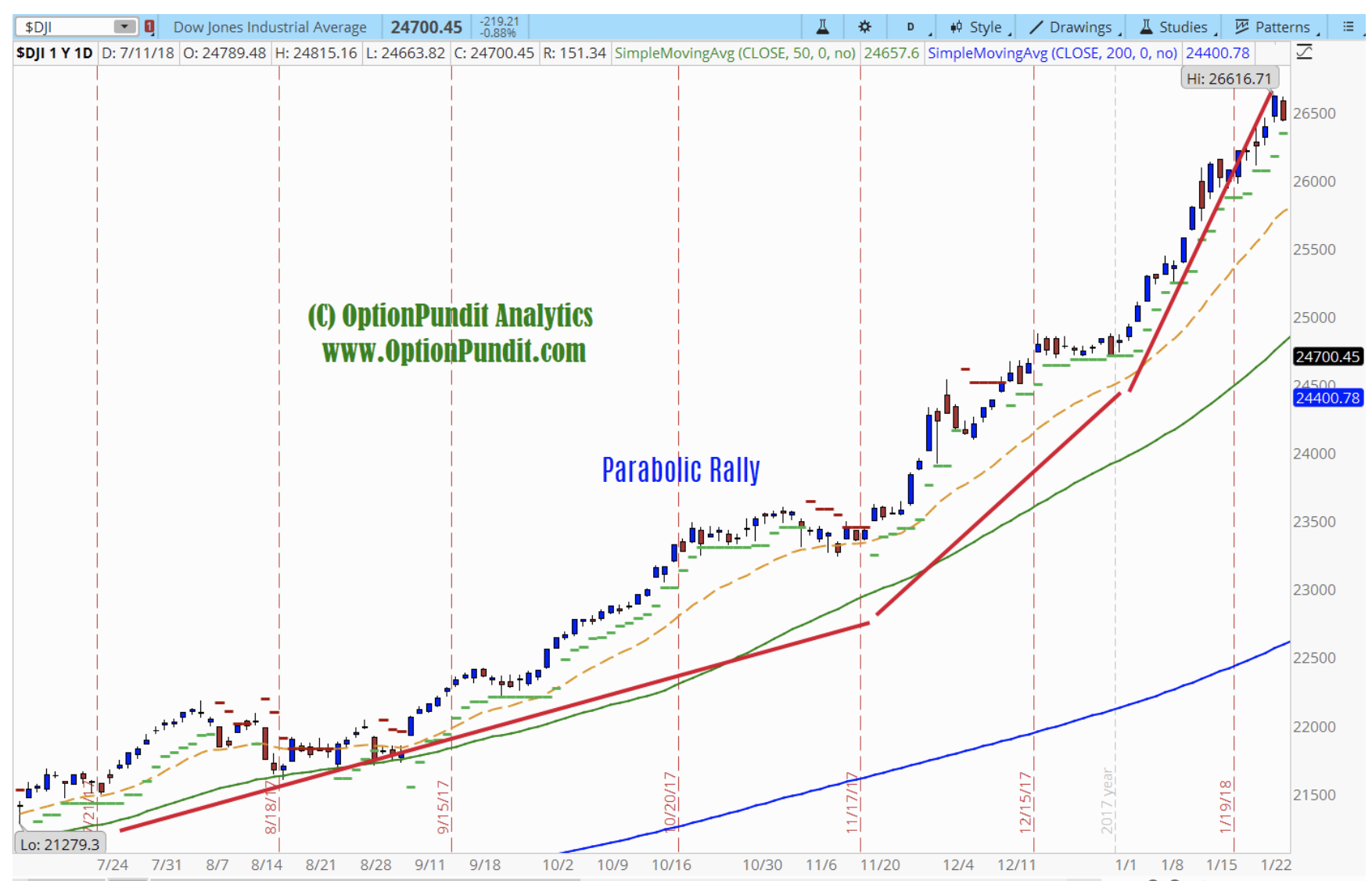

US Markets have been running a wild rally for a long time. Between Dec'17 and Jan'18, it has been going up and up before turning into a parabolic rally.

Look at the chart below; while witnessing a parabolic rally compared to the mild rally over in 2016, one should unemotionally start reducing long positions, even though the crazy rally could have made you more money had you kept your long positions for just a little longer.

Experience makes you appreciate that although in a bull market the probability of continuing the trend is greater than stopping for a correction / consolidation / ugly crash, it doesn’t mean that the unlikely will not happen — unlikely is not equivalent to impossible.

Thus, veteran traders would have begun to reduce their long exposure.

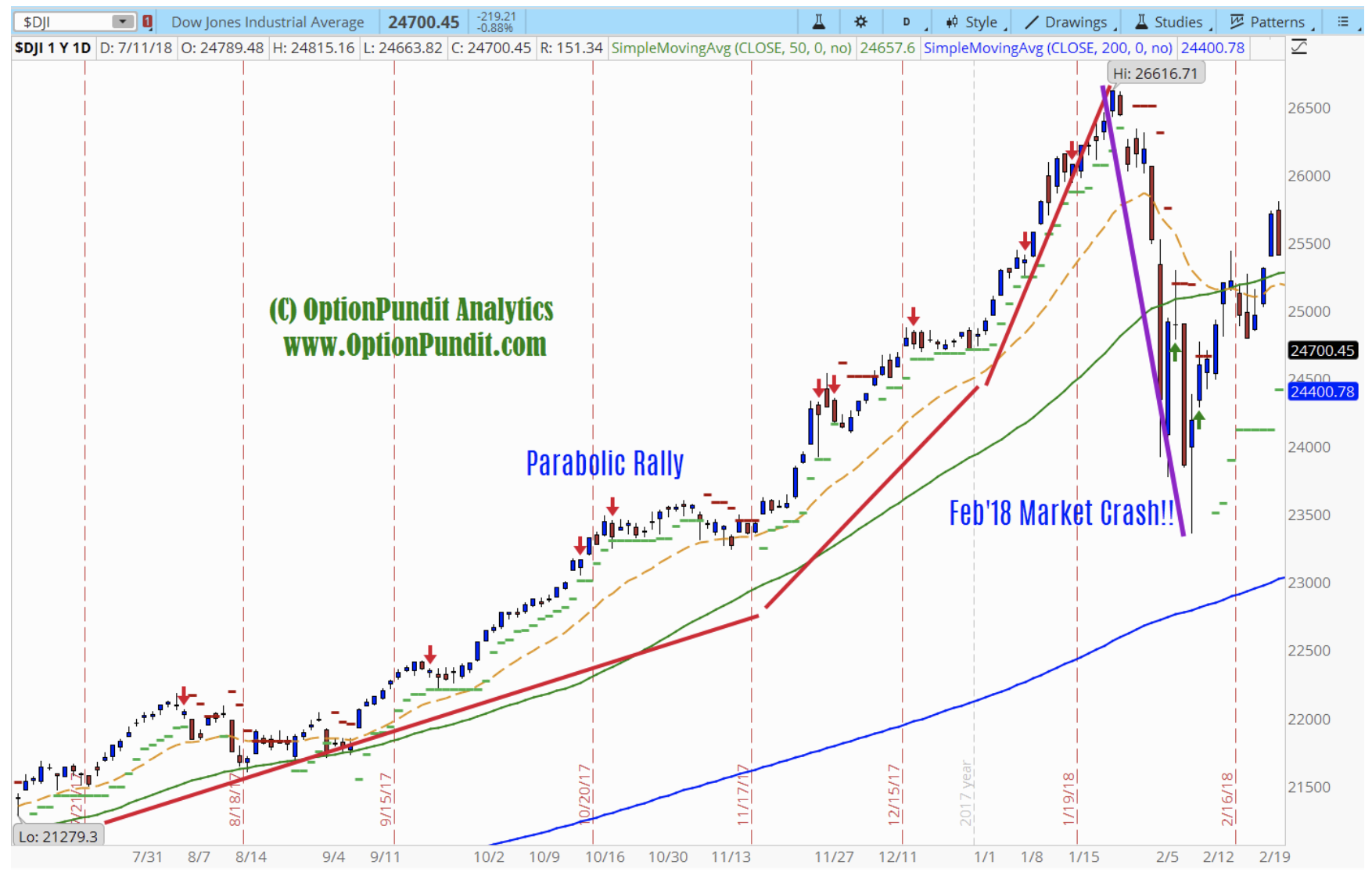

This is what happened next. The Dow Jones Industrials Index dropped over 2500 points in a matter of days, wiping out the whole parabolic rally and some more!

Though Dow Jones has recovered much from it, the deep dive has wiped out many traders with emotional bias such as “This is just a pull back”, “I shall not quit at the darkest hour before dawn” — Market remained irrational just for a few days, before they could remain solvent.

Let’s take PP33 (a powerful strategy taught in OptionPundit’s Options Success Formula) as another example.

Not every time the stock breaks through the threshold level smoothly, does it? Therefore, experience here comes to aid as it keeps you calm and patient when the stock makes a false breakout or dancing around the threshold levels.

Thus you could sit calmly when the stock is going sideways or going against you — you understand such cases are bound to happen, and they are not the ones (that make you money)! So you will and give them up and give yourself a break, rather than feeling a little frustrated having to cut loss short on the false breakout.

How to get the large amount of experience without financial ruins? You know it now.

With paper money, you will gradually stop thinking profits and losses as tangible stuff such as an iPhone, a camera, a month’s rent or salary. When you stop thinking money as stuff but multiples of risks involved, you are closer to emotionless trading.

Examples:

- I risked 1R (100% of risk parameter, which could be 5% of account size) and made 3R.

- I risked 2R and cut loss at 1.7R, etc.

Since it is not real money, you:

- Stop wanting home runs in one trade because the fake profits don’t get you better houses or cars.

- Feel OK to obey the rules for capital allocations

- Feel OK to cut loss and cut loss short.

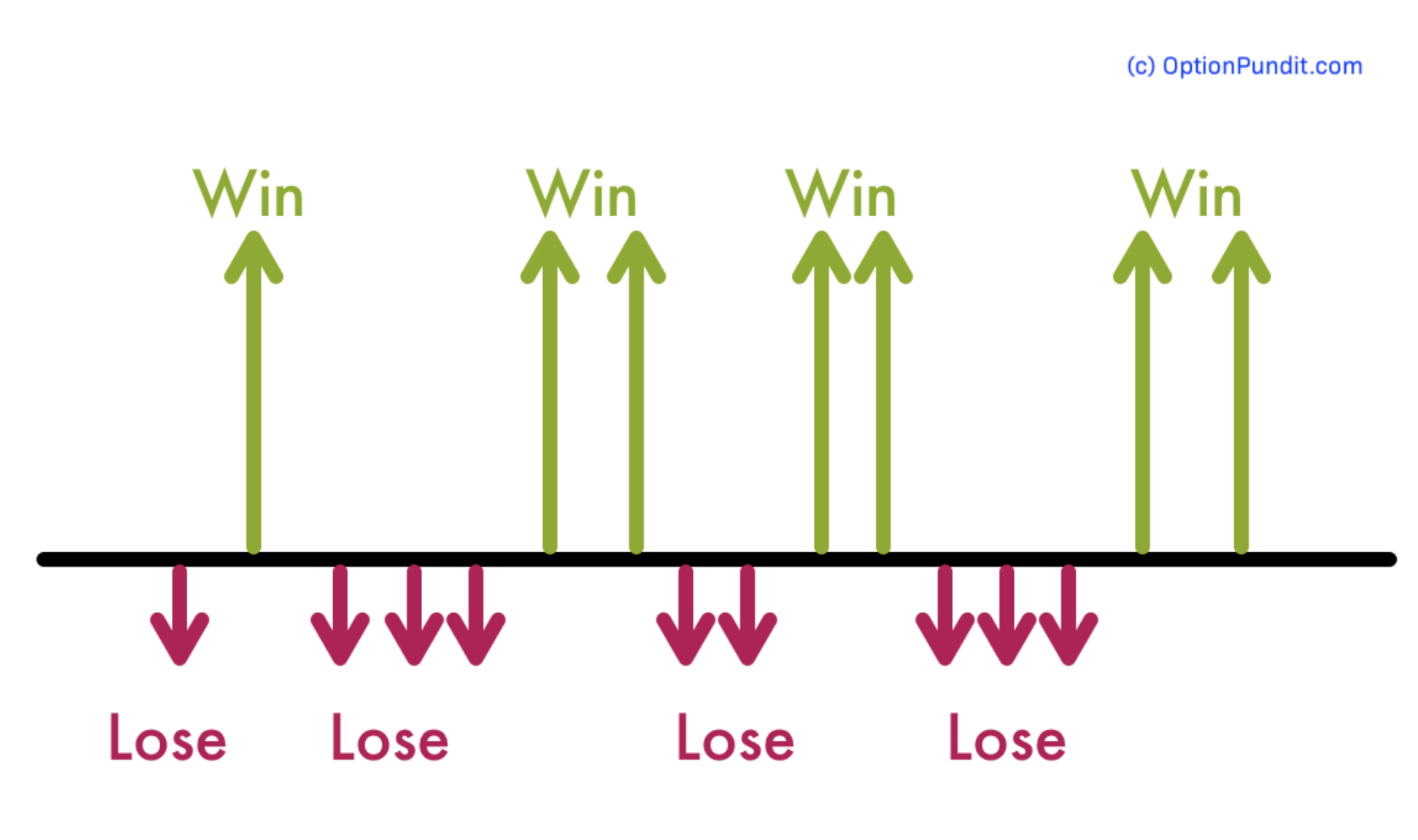

Before you know it, these practices become habits and then become you. The idea of “show hands”, “be tough and hold on” stop occurring to you. Then your trades look like these, managed losses and occasional great wins…

Wouldn’t you like this? — I hope someone told me these words when I began trading!

#4 To Develop A Trading Edge

Now, let's move one of the key reasons I still paper trade.

Market dynamics change, and so do the market internals. Being an options trader, my trades are structured and designed as per my biases around Delta, Gamma, Theta or Vega.

Whenever I have an untested trade idea or hypothesis, especially one whose risk is undefined or unclear to me, I trade those on paper money. I develop my hypothesis, trade plan, key points to watch out during the life of the trade. I develop comprehensive trading system summary and my scorecard for that new trading hypothesis.

Then I trade that hypothesis. Trade develops through various market moves. I take note and revise my hypothesis, if need be.

I do that again.

Then I repeat the process, all over again. I do it many times before I start testing it with small amounts of real money…and again…before committing large capital to it.

Paper trading or simulating your trades is essential for your long term success in trading. There is no short cut. It can save you from potential emotional disasters and/or financial ruins.

Join the conversation below by either asking a question or leaving a comment if you paper traded before diving into real-money trading? What did you learn during paper-trading? Was it worthwhile to paper trade?

If you're an experienced trader, what will you suggest to a new trader for practicing trading?

Happy Trading.

Disclaimer: The article was originally contributed by OP student Jialong Liu

Get Free Access to The Market Insider's Newsletter:

Want behind-the-scenes stock & options strategies and actionable insights delivered biweekly to your inbox? Join 40,000+ savvy investors and start growing your wealth!

*We send you weekly goodies to help you make more money. Unsubscribe anytime.