The SE (Sea Limited) stock has fallen from a high of $372 to $222 at the last close. That's a big 40% crash. Yes, the company did experience an spectacular move during post covid-19 market rally, but the recent crash is more in line with the overall growth stocks taking a hit. Stock dropped to $200+/- before rallying 10% during the recent weeks.

Did it find a support? Is there any bullish opportunity?

According to Yahoo Finance:

Sea Limited, together with its subsidiaries, engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally. It provides Garena digital entertainment platform for users to access mobile and PC online games, as well as eSports operations; and access to other entertainment content, such as livestreaming of gameplay and social features, such as user chat and online forums. The company also operates Shopee e-commerce platform, a mobile-centric marketplace that offers integrated payment and logistics infrastructure and seller services. In addition, it offers SeaMoney digital financial services to individuals and businesses, including mobile wallet and payment services AirPay, ShopeePay, SPayLater, and other digital financial services brands; and payment processing services for Shopee. The company was formerly known as Garena Interactive Holding Limited and changed its name to Sea Limited in April 2017. Sea Limited was incorporated in 2009 and is headquartered in Singapore.

In this column, I am going to look into SE stock from a potential bullish move perspective and build a strategy that offers a high probability of being profitable.

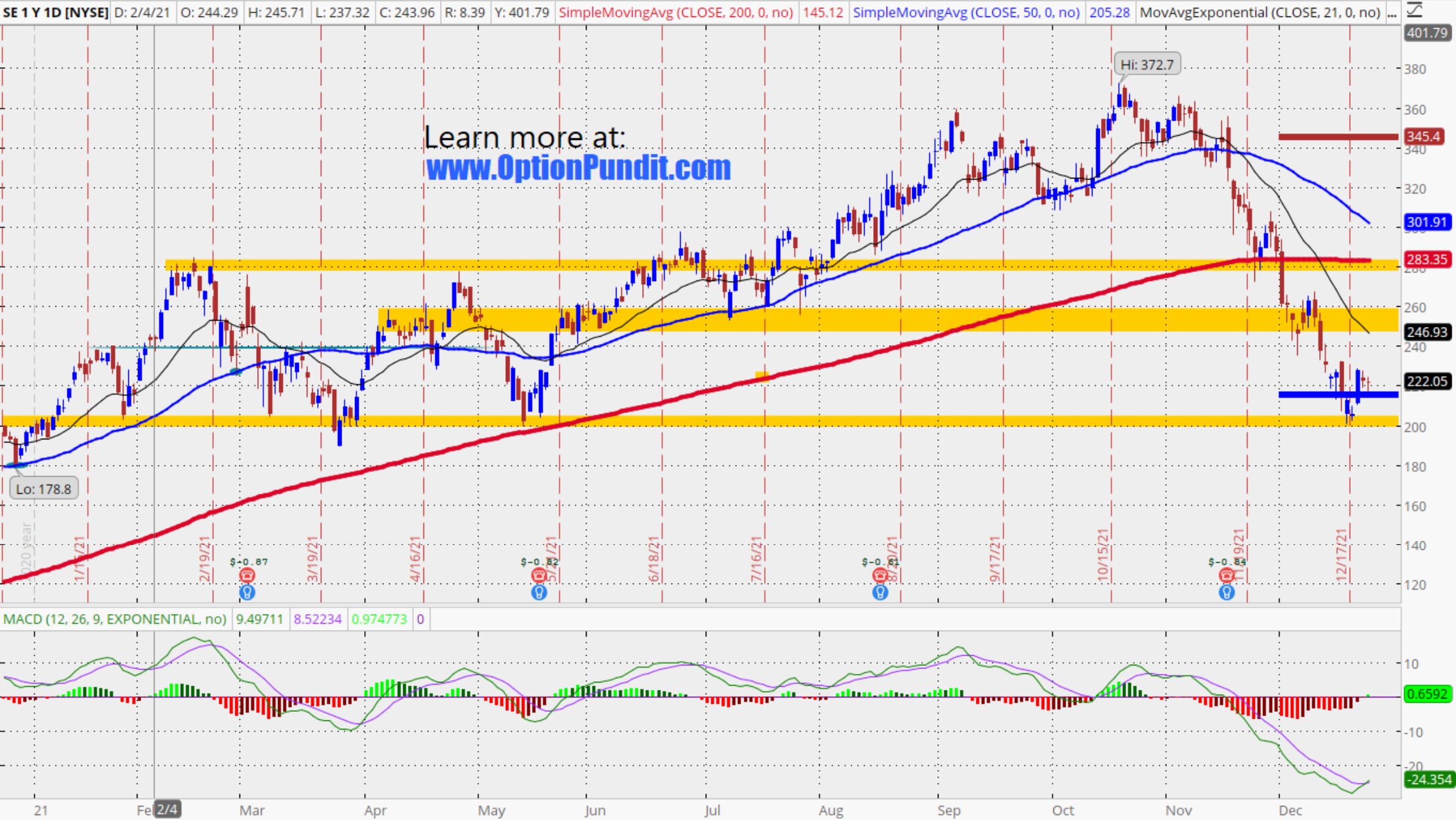

If you look at 3 amber color zone I have identified, these zones ($200+/-, $245+/- and $280+/-) acted as support and resistance in the upward move and then downward move. In fact, I can safely term $200+/- as a strong support area which was also highlight by our price projection indicator (two thick dotted Red/Blue line at the right side of the chart).

And once again SE Stock rallied from that low levels of $200+/-.

Sea Limited stock is growing (yet established business) company and based on consensus analysts estimates has a 12 month price target range of $375 to $460 that represents a fabulous upside potential.

Let's analyze how we can structure an option trade that fits the view that (1) we think Sea Limited stock will stay above $200+/- range, and (2) as stock markets enter into most bullish period of the year, the price action for it is likely to be positive.

Selling the 18 Feb 2022, $200-strike put and buying the $190 put would create a bull put spread, also known as put credit spread.

This spread was trading for around $2.62 credit on Thursday 23 Dec 2021 market close. That means a trader selling this spread would receive $262 in option premium with a maximum risk of $738. The statistical probability of this trade is 65%.

That represents a 35.5% return on risk between now and 18 Feb 2022 if Sea Limited stock remains above $200. Currently it is trading at $222.

If SE closes below 190 on the expiration date, the trade loses the full $738 unless you know how to roll and repair it. But let's assume 100% loss upfront.

The break-even point for the bull put spread is 197.38, which is calculated as 200 less the 2.62 option premium per contract.

Now, if you want to play safer and believe in price target by those top analysts, you may also build similar trade for 6 months and beyond and more time on your side. We'll cover long term credit spread in a future post but for now, I am assuming a bullish move of staying above $200 by 18 Feb 2022.

Managing the trade, Profit Taking, Risks

If and when SE stock rallies, I will pay attention to other two price zone I identified in the chart and will book profits on first tranche at the 245+/- and then 2nd tranche if it rallies all the way to 200sma. I will close and then reposition to redeploy the capital.

A 35.5% return in a few days would be nice, but the possibility of losing 100% is also very real. As such, this style of trade is only for traders with high risk tolerance and should use appropriate position sizing.

Depending on how Sea Limited stock trades on Monday (today markets are closed), traders may prefer to wait for a price higher than $2.62 for the spread.

I wouldn't hold this trade for more than 3-4 weeks just in case Sea Limited stock doesn't make a move upside during this bullish period as expected.

Remember, your ideal scenario for the trade is for SE stock to stay above $200 by Feb'22 expiration. Watch out for earning announcements as there would be earnings risk with this trade if held to expiration and earnings are before the expiration.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

Please feel free to ask question or post your comments to join the conversation below.

Happy Trading,

Manoj Kumar

Get Free Access to The Market Insider's Newsletter:

Want behind-the-scenes stock & options strategies and actionable insights delivered biweekly to your inbox? Join 40,000+ savvy investors and start growing your wealth!

*We send you weekly goodies to help you make more money. Unsubscribe anytime.