The covered call strategy is one of the most popular options trading strategies that involves selling call options against stock that you already own thus enhancing investment returns on a stock holding.

Covered Call Explained

Let's dive deeper to understand all about it.

Imagine, over the years, you have been building your stock portfolio, investing through monthly company stock purchase plans only to realize that its performance is not in line with overall market. Or have you ever been in a situation where your preferred stocks keep going up and up until you bought them? What’s more, the moment you bought those promising stocks, they started to go down or go sideways for a long time period.

These are the time periods where you might find your capital is stuck with the stocks invested, and there is nothing you could do except for waiting.

If letting go of the shares at the current market price is not an option you want to consider, and you are tired of capital occupied but generating no profit, you should learn how to sell a covered call.

What Is a Covered Call?

Before diving deeper, lets refresh what is a call option and its mechanics first.

What is a Call Option?

A call option is an option contract that gives the option buyer the right to buy an underlying stock at a specific price before or on a specific date. The specific price is called Strike Price and the specific date is called Options Expiration date. To own the right, you need to pay for the price of the option, which is called Option Premium.

When you sell a call option, it means you writes the option contract to sell the underlying stock at the strike price on or before the expiration date.

How does a Call option work?

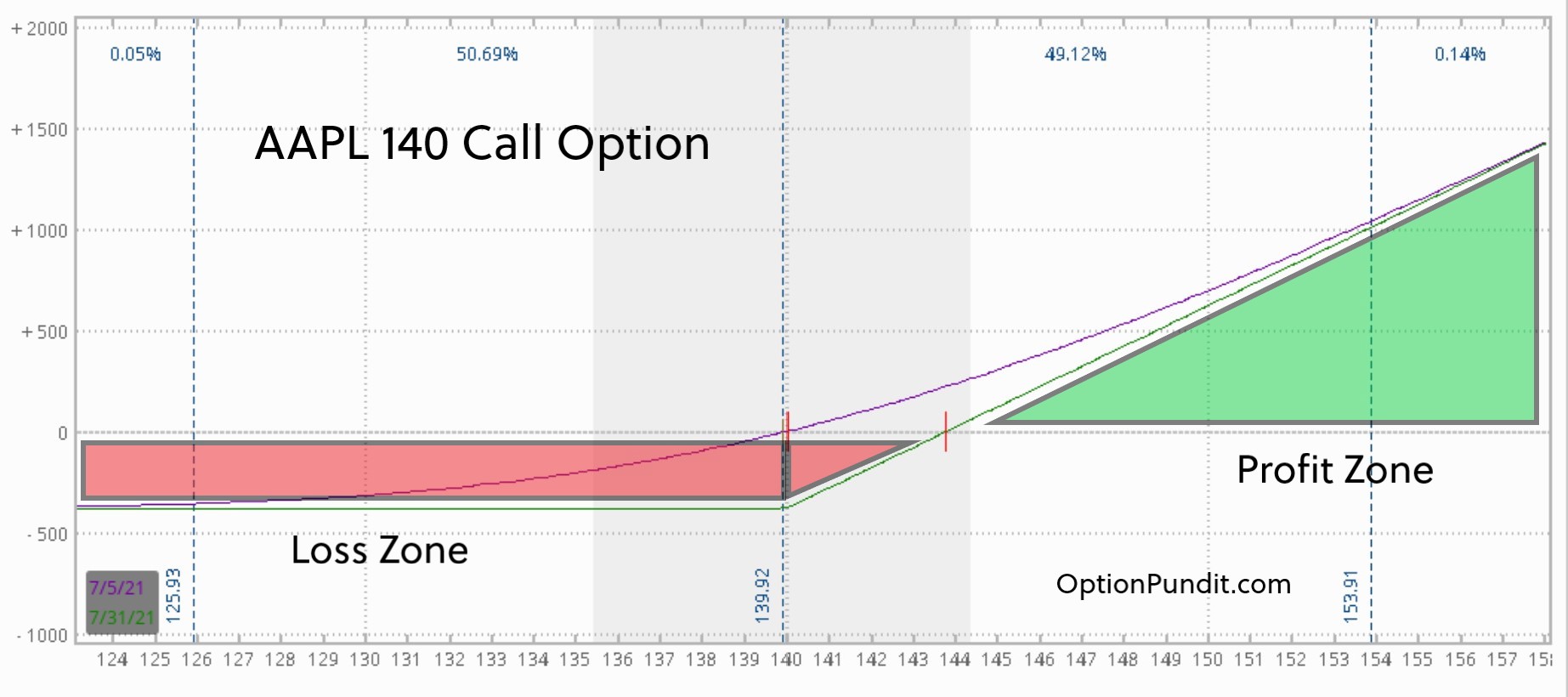

Figure 1 is a simple chart that explains the key characteristics of a Call option.

Let’s say you buy a Call option on stock Apple (AAPL), with strike price at $140, at $3.80 per contract. This option expires on 30 Jul 2021 and it’s an American style option.

What it means is that you own the right to buy AAPL at $140 on 30 Jul 2021 regardless of how much stock AAPL is traded at. For example, if AAPL is traded at $155 on 30 Jul 2021, you get to buy it at $140, because you have the right to exercise the option.

On the other hand, if stock A is traded at $130, you do need to buy it at $140. You can simply let your right expire.

One important note is that one stock option controls 100 shares. Hence, your total cost of the option will be $380. And your break-even price will be $143.80.

Here is the breakdown on the calculation:

Option on Stock A expires on 30 Jul 2021

Strike Price = $140

Cost = $3.8 x 100 = $380

Break-even point = $140+ $3.8= $143.80

What is a Covered Call?

A covered call strategy is constructed by holding a long position in a stock and then selling 1 (writing) call option for each 100 shares of the same stock position. It is also known as Buy-Write strategy.

This is a stock yield enhancing strategy and in case stock price skyrockets, potential gains are capped by the option strike thus sold. It can also be interpreted as mildly bullish strategy.

Option Selling is also called Option Writing.

How does a covered call work?

In covered call investment strategy, you write a call option collecting option premium. As part of writing this option contract, you now have the obligation to sell underlying stocks to the buyer at the strike price should the buyer exercise their options.

You might wonder, what if you don’t have the stocks and the buyer exercise his call options?

Here comes another important criterion for selling a covered call, you need to own the stocks first, typically in multiple of 100 shares of stock, and hence it’s called covered call, because your call options are covered by ownership of the underlying stocks.

For example, if you own 500 shares of AAPL, you can sell 5 contracts of call options on AAPL and in return collect options premium. In this way, you would have generated additional investment yield from AAPL shares even if it goes sideway.

Why would an option buyer pay premium?

Because option buyer expects stock prices to go up and by paying option premium he is securing the right to buy stocks at lower price thus pocketing potential profits.

Covered Call Example

Here is an example to how to structure a covered call helping you understand gain and loss from the trade.

There are 3 steps in a covered call set-up:

- Buy the shares you like

- Sell a Call Option at your chosen strike price

- Wait for premium to decay

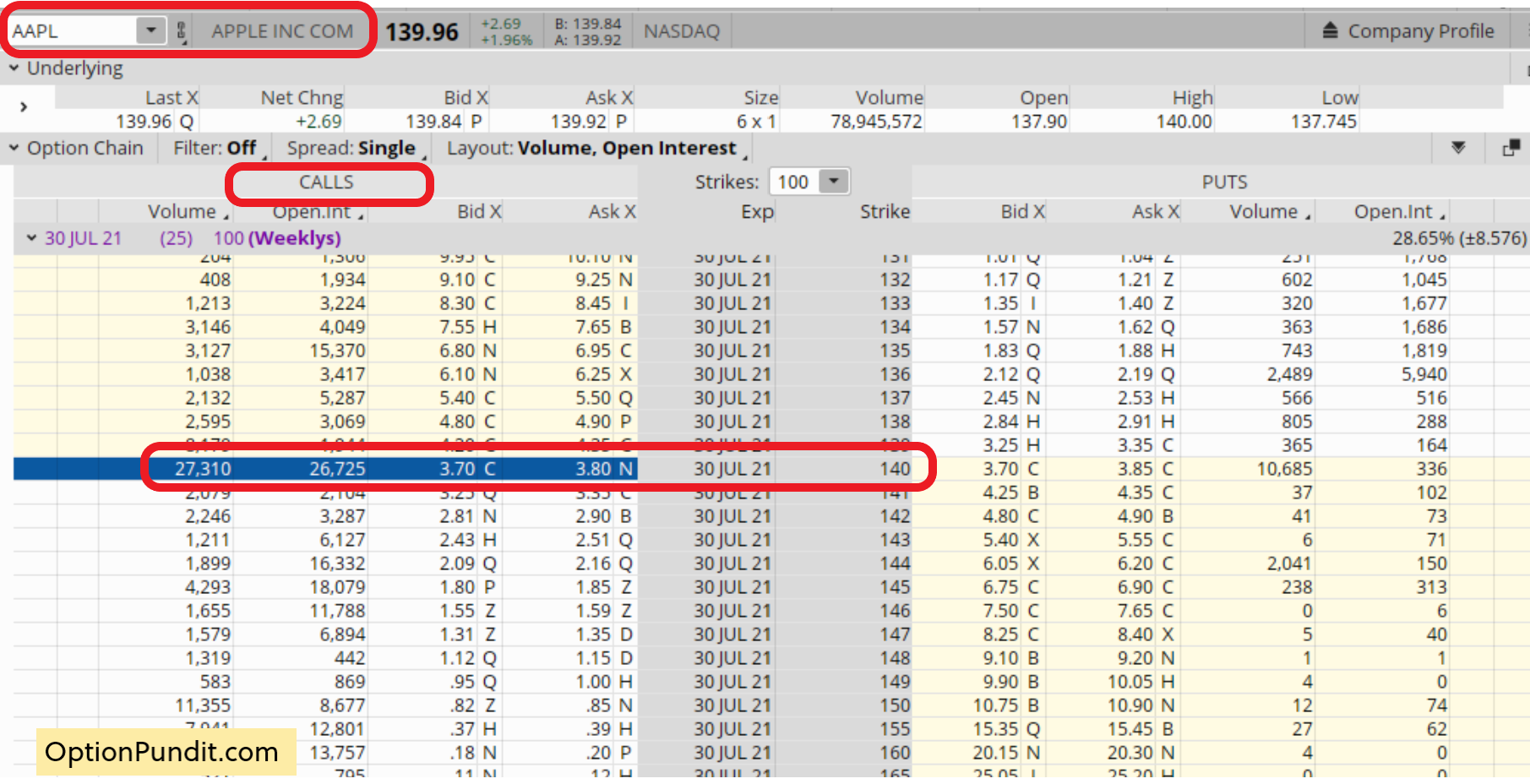

Say you own 100 shares of Apple Inc (AAPL), which is trading around $139.96. There are several strike prices for each expiration month (see option chain below). For now, let’s look at the calls that are OTM, that is, the strike prices are higher than the current price of the underlying stock.

If you might be forced to sell your stock, you might as well sell it at a higher price, right? So, you might choose $140 strike for $3.80, thus your original cost of shares will be $140-$3.8=$136.2

Source: the thinkorswim®platform from TDAmeritrade. For illustrative purposes only. Past performance does not guarantee future results.

Another way of think of this premium from this strategy is that over a period of time covered call reduces cost basis of shares and one may even extend this to overall portfolio to enhance returns.

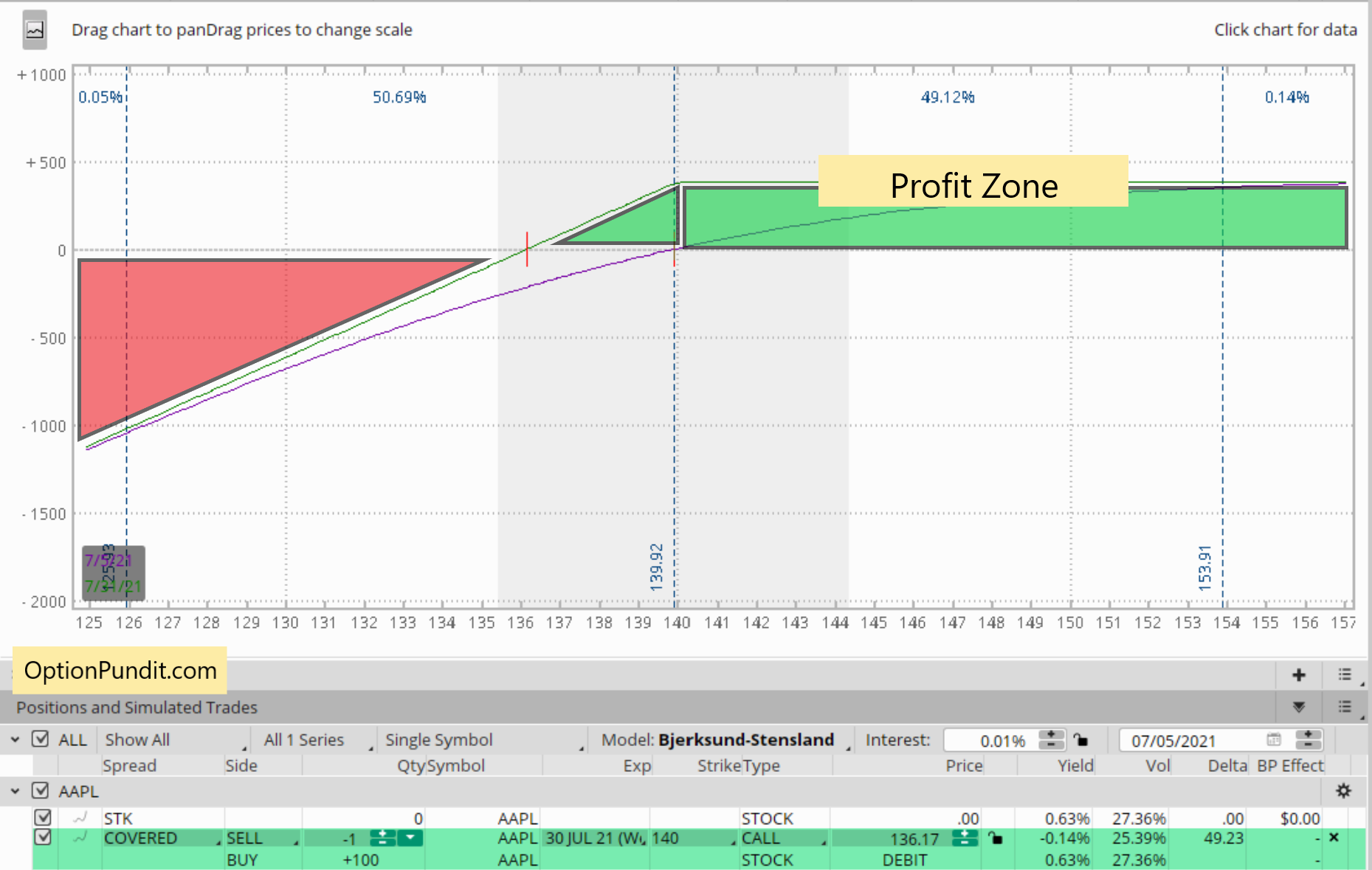

How to Calculate Maximum Profit & Loss from a covered call

Here is how to calculate Profit & Loss for covered call:

-

Share purchase at $140 - Call Option sold for $3.80 premium

- Thus original cost for the entire position $140 - $3.80 = $136.20

- Upside potential is capped up to the strike price sold plus the option premium received. Thus if stock rallies beyond $140, profit is capped at $3.80.

- The yield is 2.7% in a month.

- Loss of principle capital will occur if stock drops below $136.20

Summary of Covered Call Strategy

- It is a mildly bullish strategy.

- You own the underlying stocks and thus It is capital intensive strategy as one needs to fund stock purchase before writing call options.

- You are the seller of call options, also known as call writer or option writer

- A covered call is constructed by holding a long position in a stock and then selling (writing) call options on that same asset, representing the same size as the underlying long position.

- A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops.

Key Questions on Covered Call Strategy

Are covered calls risky? What are the downside risk of a covered call?

A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops.

Though option premium provides some downside risk protection, potential loss of capital may occur if stock drops significantly.

There is opportunity risk in case stock price spikes and continues to rise as option writer can't profit from this rally since on the upside, profit potential is capped by option strike sold. On the downside however, there is the full risk of stock ownership below the breakeven point.

Your risk of having covered calls mainly comes from your ownership of the underlying stocks. There are three scenario how an underlying stock can behave, let us examine each scenario closely.

- What will happen to a covered call if the underlying stock price goes above strike price?

If the underlying stock price goes above the strike price, you will keep all the premiums collected and your shares will be called away and sold at the strike price.

- What will happen to a covered call if the underlying stock price remains between my average price and strike price?

If the underlying stock price remains between your average price and strike price, you get to keep all the premiums and your ownership on the stock remains.

- What will happen to a covered call if the underlying stock price goes below my average price?

This is the scenario where you will lose money if the stock price keeps going down. On the one hand, you get to keep all the premiums collected. On the other hand, your shares are losing money as the price is traded below your average price.

How far out should you sell covered calls? What Premium Should I Sell the Call?

This is a question that has no definite answers. It depends on what is your objective. Your objective could be to generate higher ROI but you are ok to let the shares be called away. Or, your objective could be keeping your shares as priority and generate additional yield to enhance overall ROI..

Here is what you should know before selecting a strike price. If you choose a strike price too near the current price, you will have a thicker premium and higher chance of letting your shares to be called away. If you choose a strike price too far away from the current price, the premium will be little, but it also reduces the chances of your shares to be called away. It’s important to select at a strike price which has acceptable premium amount and is also at a price which you are okay to sell the shares at.

Of course, this depends on the underlying stock and market conditions such as implied volatility. You may wish to consider selling the call with a premium that represents at least 2% of the current stock price (premium ÷ stock price).

Is a covered call bullish or bearish?

When you are buying stocks, the stock alone is bullish, because your stock profits if the price goes up. When you are selling call options, the selling of call option alone is bearish, because when the underlying stock price goes down you will make a profit from the premium collected. A covered call consists of both buying stocks and selling call options, so I would say it’s neither bullish nor bearish.

The situation that benefits your position the most is when the underlying stock prices are going sideways. What you definitely don’t want to see is when the underlying stock turns bearish and keeps going down, because it would mean your stock holdings are at risk. When the underlying stock is turning bullish, you could be happy with the situation if you are happy to sell your shares at the strike price while collecting some premium.

What happens when a covered call is exercised or expired in the money?

When a covered call option position is exercised, the stock position is closed as shares are taken away at the strike price call option was sold and funds are deposited into the trading account by the broker.

Are covered calls a profitable strategy?

Yes

Is there such a thing as a covered put?

Yes, usually covered with cash.

Does Warren Buffett sell covered calls?

No, Warren Buffett generally prefers to write put options as he wants to build his long stock positions and reduce his purchase price.

What is a poor man's covered call?

When one replaces long stock positions with long term call options, often termed as LEAPS, it is called poor man's covered call.

What is the maximum profit of a covered call?

The maximum profit of a covered call is equivalent to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received.

What Is a Covered Call?

A covered call is popular options strategy constructed by holding a long position in a stock and then selling (writing) call options on that same asset, representing the same size as the underlying long position. It is also known as a “buy write,” is a two-part strategy in which stock is purchased and calls are sold on a share-for-share basis.

What Is a Cover?

The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise.

What Is a Call Option?

The buyer pays the seller of the call option a premium to obtain the right to buy shares or contracts at a predetermined future price.

What is a Buy Write?

The term “buy write” describes the action of buying stock and selling calls at the same time.

Next Steps:

Before deploying this strategy in your portfolio, there are additional parameters you need to think about e.g. what are the best stocks for covered call strategy and how to find those? how to minimize risk of losing principal amount? how long should you run this strategy? what is the optimum days to expiration (DTE)? how to adjust the trade when underlying stock is very volatile and so on. If would like us to keep you informed when we publish a FREE covered call trading idea, pls join the community by signing-up below.

Hope you enjoyed the article and picked up a few insights that might be useful in your trading. Leave a comment or question below to join the conversation about this wonderful strategy.

Happy Trading.

Get Free Access to The Market Insider's Newsletter:

Want behind-the-scenes stock & options strategies and actionable insights delivered biweekly to your inbox? Join 40,000+ savvy investors and start growing your wealth!

*We send you weekly goodies to help you make more money. Unsubscribe anytime.